Super Micro Computer Inc. – SMCI stock forecast 2024, 2025, 2030, 2040

Super Micro Comppter Inc (SMCI) stocks lately caught everyone’s attention due to a spike in their prices (+3000%) in the last few quarters. The company specializes in developing customized high-performing efficient servers for their partners leading in advanced technological space like Al, cryptos, robotics, and gaming. According to the Al stock price forecaster at FinTechBrains, the recent long-term SMCI stock forecast predicts prices may touch $1230 in 2024, slightly fall in prices to $1191.29 in 2025, gaining back to $1266.76 in 2026, and leap further to $1565.15 by the end of 2030 while making its all-time high of $1932.08 in 2035 and $2294.13 in 2040.

| Company | Information |

|---|---|

| Company Name | Super Micro Computer, Inc. |

| Founded on | September 1, 1993 |

| CEO | Charles Liang (since 1993) |

| Industry Type | Information Technology products and solutions |

| SMCI stock price today per share (13th, July 2024) | $909.96 USD |

| Market Capitalization | 53.28 billion USD |

| Services | Supplier of storage, accelerated & sustainable green cloud computing, and network solutions. |

| Competitors | Dell, HP (compete in few sections only) |

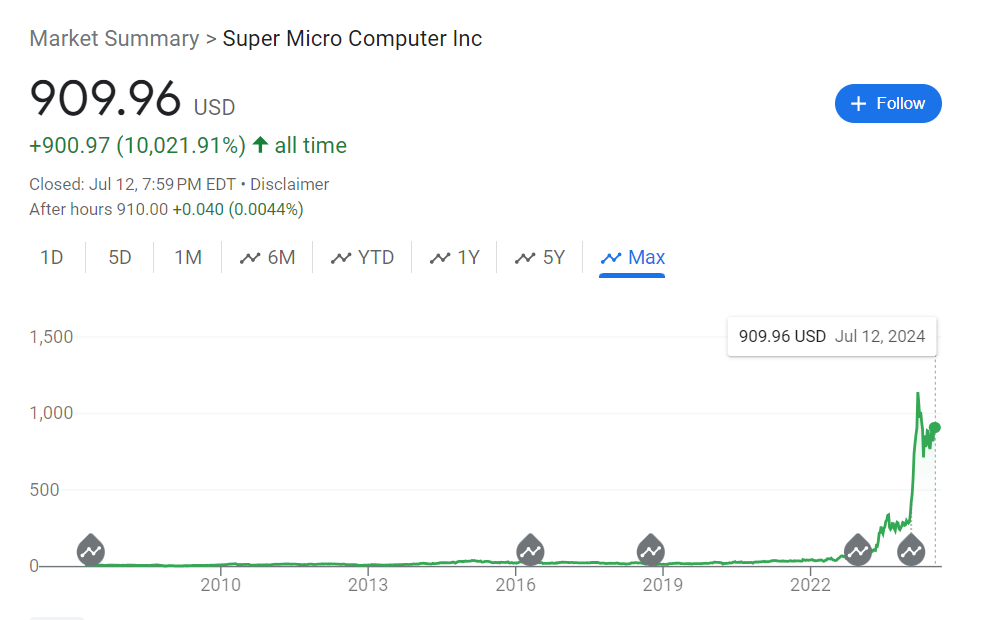

SMCI stock price history

| YEAR | SMCI Share Prices (in USD) | YOY% yield |

|---|---|---|

| 2013 | $ 17.23 | |

| 2014 | $ 37 | 115 % |

| 2015 | $ 42 | 14 % |

| 2016 | $ 34.69 | -17 % |

| 2017 | $ 31.75 | -8 % |

| 2018 | $ 24.95 | -21 % |

| 2019 | $ 25.26 | 1 % |

| 2020 | $ 33.3 | 32 % |

| 2021 | $ 47.17 | 42 % |

| 2022 | $ 95.22 | 102 % |

| 2023 | $ 357 | 275 % |

SMCI stock long-term forecast | SMCI stock 10-year forecast

| YEAR | Forecasted High Share Prices (in USD) | YOY% yield | Forecasted Low Share Prices (in USD) |

|---|---|---|---|

| 2024 | $1299 | 244% | $ 275.88 |

| 2025 | $ 1191.29 | -3 % | $ 624.07 |

| 2026 | $ 1266.76 | 6 % | $ 681.94 |

| 2027 | $ 1341.85 | 6 % | $ 739.82 |

| 2028 | $ 1416.60 | 6 % | $ 797.70 |

| 2029 | $ 1491.02 | 5 % | $ 855.57 |

| 2030 | $ 1565.15 | 5 % | $ 913.45 |

| 2031 | $ 1639.01 | 5 % | $ 971.33 |

| 2032 | $ 1714.61 | 4 % | $ 1029.20 |

| 2033 | $ 1785.98 | 4 % | $ 1087.08 |

| 2034 | $ 1859.13 | 4 % | $ 1144.95 |

| 2035 | $ 1932.08 | 4 % | $ 1202.83 |

| 2040 | $ 2294.13 | 17 % | $ 1492.21 |

SMCI stock daily short-term prediction | SMCI stock forecast for tomorrow and next week

| Day | Date | SMCI Short term forecast price (in USD) |

|---|---|---|

| Monday | 15-July-2024 | $ 928.09 |

| Tuesday | 16-July-2024 | $ 931.33 |

| Wednesday | 17-July-2024 | $ 934.57 |

| Thursday | 18-July-2024 | $ 937.81 |

| Friday | 19-July-2024 | $ 941.04 |

| Monday | 22-July-2024 | $ 950.76 |

| Tuesday | 23-July-2024 | $ 954.00 |

| Wednesday | 24-July-2024 | $ 957.24 |

| Thursday | 25-July-2024 | $ 960.48 |

| Friday | 26-July-2024 | $ 963.71 |

| Monday | 29-July-2024 | $ 973.43 |

| Tuesday | 30-July-2024 | $ 976.67 |

| Wednesday | 31-July-2024 | $ 979.91 |

| Thursday | 1-Aug-2024 | $ 983.15 |

| Friday | 2-Aug-2024 | $ 986.38 |

| Monday | 5-Aug-2024 | $ 996.10 |

| Tuesday | 6-Aug-2024 | $ 999.34 |

| Wednesday | 7-Aug-2024 | $ 1002.58 |

| Thursday | 8-Aug-2024 | $ 1005.58 |

| Friday | 9-Aug-2024 | $ 1009.05 |

| Monday | 12-Aug-2024 | $ 1018.77 |

| Tuesday | 13-Aug-2024 | $ 1022.01 |

| Wednesday | 14-Aug-2024 | $ 1025.25 |

| Thursday | 15-Aug-2024 | $ 1028.49 |

| Friday | 16-Aug-2024 | $ 1031.72 |

SMCI stock price chart

Must Visit – ARM Holdings PLC – ARM Stock Forecast through 2024, 2030, 2035, 2040

Must Visit – AMD Stock Forecast 2024, 2025, 2030, 2035, 2040

Must Visit – HOLO Stock Prediction 2024, 2025, 2027, 2030, 2035, 2040

Must Visit – Walmart Stock Forecast 2024, 2030, 2035, 2040

Must Visit – International Business Machines- IBM stock forecast 2024, 2025, 2030, 2035, 2040

Must Visit – Nvidia (NVDA) Stock Price Prediction for 2024, 2025, 2026, 2030, 2035, 2040, 2050

Must Visit – Verizon (VZ) Stock Forecast for 2024, 2030, and 2040

Must Visit – Lucid Stock Prediction 2025, 2028, 2029, 2030, 2034, 2040, 2050 | Lucid Stock Forecast

Must Visit –Tata Motors Share Price Target 2025, 2026, 2027, 2028, 2029, 2030, 2033, 2035, 2038, 2040

Must Visit – Amazon Stock Prediction 2024, 2025, 2030, 2033, 2040, 2050 | Amazon Stock Forecast

Must Visit – Microsoft Stock Forecast 2024 – 2025 – 2027 – 2028 – 2029 – 2030 – 2035 – 2040

Read More – Here

SMCI Stock Forecast 2024

By 12th/July/2024, SMCI’s share price in 2024 was recorded at $909.96. Our Analysts forecast SMCI’s stock price to linger between $1150-$1230 by the end of 2024. The all-time low SMCI share price in 2024 would trade at $275.88.

| Stock Name | Stock Price (in USD) |

|---|---|

| SMCI Stock Forecast 2024 | $ 1150 – $ 1230 |

Reason –

Super Micro Computer Inc. is a pioneer in developing light, clean, and environment-friendly servers for heavy processing software in Al, robotics, gaming, crypto mining, and cloud computing space. In fact SMCI has caught investors’ attention by partnering with NVIDIA and AMD to provide customized servers for their powerful GPUs, which are used for complex software processing. As we all know, NVIDIA is already ahead of its game by 10 years, and the fact that it gets such complex computing IT solutions from SMCI makes this company more special. So, as the leading partners progress, no doubt SMCI stock prices will follow the trail due to dependency

SMCI Stock Forecast 2025

Our analysts further foresee SMCI per stock price to be traded at $1191.40 in 2025 falling by -3% compared to the previous year of 2024. While the predicted all-time low price of SMCI stock would form a strong cushioning to the moderate bull run at $624.07 in 2025.

| Stock Name | Stock Price (in USD) |

|---|---|

| SMCI Stock Forecast 2025 | $ 1191.40 |

Reason –

2025 will see NVIDIA and AMD competing fiercely. While NVIDIA buckles up to launch new data centers and Blackwell Ultra GPU to form its special base in Al networking with NVLink 5 switch in 2025. On the other hand, AMD will pull up its socks by introducing powerful Glass substrate complex chips forming a multi-chipset design for complex processing performance. The combination of both will call in for accelerated cloud computing solutions and more from SMCI in 2025.

SMCI stock forecast 2026-2030

Standing in 2024, the SMCI per share prices will start from $1299, slightly rising to $1266.76 in 2026 while touching $1416.60 midway in 2028 and finally trading between $1500.23-$1565.15 in the next 5 years by the end of 2030 with the total year on year change of +28% from 2026. In these 5 years, SMCI shares will touch its all-time low of $681.94 per share value.

SMCI stock forecast 2031-2035

The SMCI share price will rise from being at $1639.01 in 2031 to $1932.08 in 2035 thereby making an overall total Year-on-year change of +22% in the next 5 years. On average the stock will climb upwards by only +5% to +6% annually, for SMCI stock forecast in 5 years between 2031 to 2035.

SMCI stock forecast 2036-2040

SMCI stock prices are expected to experience an increase in prices in these 5 years. The shares will make their record level high at $2004.83 in 2036, then soar to $2149.80 in the next 2 years by 2038, and will finally end 2040 at $2294.13 accounting for the total rise in share prices by +18% from 2036 (i.e in last 5 years).

Frequently Asked Questions | FAQ

Who is the largest shareholder of SMCI?

| Holder | % |

|---|---|

| Vanguard Inc | 12.42 % |

| JP Morgan Chase & Corporation | 1.87 % |

| Blackrock Inc. | 10.80 % |

| Morgan Stanley | 1.34 % |

| State Street Corporation | 4.66 % |

| Northern Trust Corporation | 1.32 % |

| Geode Capital Management, LLC | 3.10 % |

| Disciplined Growth Investors, Inc. | 2.04 % |

Is SMCI stock splitting? Just like Nvidia did?

Generally, the agenda behind splitting a stock is to make its price more reasonable to the large pool of investors. At present the peak SMCI share price was recorded at $1229 in 2024 and if the prices stick to the same pace then in less than the next 2 years Super Micro Computer Inc. may announce their first stock split ever before 2026 attracting more investors.

SMCI stock price buy or sell

SMCI is potentially a buy even though the stock prices have been skyrocketing in the last few quarters. The analysts at FTB feel that SMCI share prices will keep rising in the future closely imitating NVIDIA’s stock performance and soon due to high SMCI per stock prices, the company may announce its first stock split amongst their investors.

| Ratios | Ideal range should be | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| PE Ratio | (20 – 25) | 20.44 | 7.35 | 15.70 | 17.49 | 13.42 |

| Debt/Equity Ratio | (1 -1.5) | 0.15 | 0.42 | 0.09 | 0.03 | 0.03 |

| ROE | 15% > | 35.60% | 22.70% | 10.40% | 8.30% | 7.90% |

| EV/EBITDA | 10 | 16.25 | 6.43 | 10.86 | 10.96 | 6.29 |

Having known the fundamentals of SMCI, any smart investor would invest only 50% of their allotted amount into SMCI shares and wait until the company announces its first stock split. Post SMCI stock split, buy more shares from the remaining amount. This way as a smart investor, one could end up owning more SMCI stocks in the future.

Is SMCI stock a good investment | Conclusion

It is quite evident from the financial ratios and statements that SMCI is a promising and emerging company in the futuristic space like Al, robotics, and gaming. While the market sentiments on the company are positive with core fundamentals of SMCI looking in great shape, it is also important to dig deeper into financial statements to understand the actual health of the organization.

The elemental attributes like Revenue, sales, net profits, and cash flow are consistently increasing year by year. There are investors in the market who are ready to pay $15 for every $1 the company makes in profit which currently makes the stock undervalued and more in demand while the average operating efficiency of SCMI for the last 5 years has been 8.35 (which is great).

The company is also diligently using its investors’ money with a Return on Equity (ROE) of +16% (and growing year on year) with almost negligible debt involved making SMCI less leveraged and more investable. The USP of the company is unique and quite difficult to cope with all the heavy investments, long trailing expertise, and onboarding of some competitive partners involved.

Note – Kindly use this blog information for educational purposes only. Investments are usually risky and subject to market emotions, so consult a licensed financial advisor before investing in the stocks.

13 Comments