Tesla stock price prediction 2025, 2026, 2027, 2029, 2030, 2038, 2040 | Tesla stock price target 2034, 2036

Tesla, Inc. was established in 2010 and is headquartered in Austin, Texas. It is a leader in electric vehicles and renewable energy solutions. They majorly design, manufacture, design, and sell fully electric cars like the Model 3, Model Y, Model S, and Model X. This multi-bagger stock has been in everybody’s radar which piqued FinTechBrains to work on the Tesla stock prediction for the upcoming years

1. Tesla Stock Price Target History

| Year | Value | High | Low | YOY% change |

| 2015 | 17.88 | 19.11 | 12.09 | |

| 2016 | 16.05 | 17.96 | 9.4 | -10 % |

| 2017 | 24.11 | 25.97 | 14.06 | 50 % |

| 2018 | 23.62 | 25.83 | 16.31 | -2 % |

| 2019 | 27.89 | 29.02 | 11.8 | 18 % |

| 2020 | 235.22 | 239.57 | 23.37 | 743 % |

| 2021 | 381.59 | 414.5 | 179.83 | 62 % |

| 2022 | 359.2 | 402.67 | 108.24 | -6 % |

| 2023 | 267.43 | 299.29 | 101.81 | -26 % |

| 2024 | 187.29 | 251.25 | 160.51 | -30 % |

CAGR of Last 10 years is 26%

Must Watch – Tata Motors Share Price Target 2025, 2026, 2027, 2028, 2029, 2030

Must Watch – Super Micro Computer Inc. – SMCI stock forecast 2024, 2025, 2030, 2040

MUST Watch – Amazon Stock Prediction 2024, 2025, 2030, 2033, 2040, 2050

Must Watch – LUCID MOTORS STOCK PREDICTION

Must Watch – Ford Stock Forecast 2024, 2025, 2030, 2035, 2040, 2050

Must Watch – Nio Stock Forecast 2024, 2025, 2030, 2040, 2050 | Nio Stock Target

Must Watch – Nvidia Stock Price Prediction for 2024, 2025, 2026, 2030, 2035, 2040, 2050

Must Watch – Apple Stock Price Prediction 2024, 2025, 2030, 2040, 2050

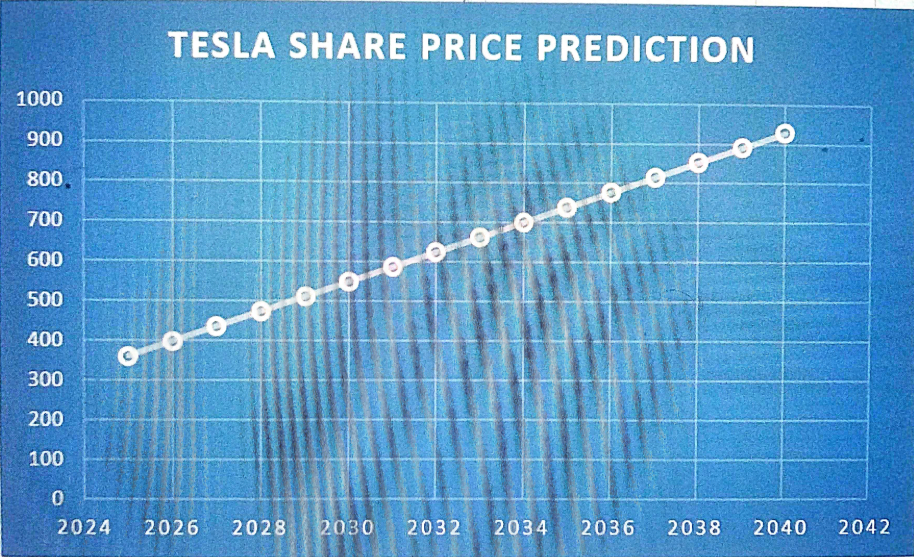

2. Tesla price target in 5 years? Tesla stock price prediction?

| YEAR | PREDICTION VALUE | PREDICTION HIGH | PREDICTION LOW | PREDICTION CAGR |

| 2025 | 361 | 416 | 162 | 35 % |

| 2026 | 398 | 460 | 180 | 34 % |

| 2027 | 436 | 505 | 198 | 27 % |

| 2028 | 474 | 549 | 216 | 26 % |

| 2029 | 512 | 593 | 233 | 23 % |

| 2030 | 550 | 638 | 251 | 6 % |

| 2031 | 588 | 682 | 269 | 3 % |

| 2032 | 625 | 726 | 287 | 3 % |

| 2033 | 663 | 771 | 305 | 5 % |

| 2034 | 701 | 815 | 323 | 7 % |

| 2035 | 739 | 859 | 341 | 16 % |

3. How much will Tesla stock cost in 2025?

Tesla plans to introduce a new electric vehicle called “Redwood” by mid-2025. It’s described as a compact crossover aimed at the mass market. This model would be described as a compact crossover and a next-generation EV.

Investors have eagerly awaited this moment since 2020, as the next-gen EVs promise affordability and intelligence. Priced at $25,000 per unit, they’ll compete with cheaper gasoline cars, making electric vehicles more accessible to all.

Our Analysts see a potential risk to Tesla’s low-cost car plans due to their intense competition with Chinese EV competition and by taking into account the risks involved, our experts forecast Tesla’s stock to reach $361 per share by 2025, with a possible high of $416 per share.

The predicted CAGR returns for the year 2025 rounds up to 35%, i.e. had you invested in Tesla in the year 2015, by the year 2025 your investment would reap a compounded interest of 35%.

4. How much will Tesla stock cost in 2026?

Tesla’s stock is expected to reach $398 per share by 2026, with an average high of $460 per share, reflecting the company’s strong position in the electric vehicle market and its strategic focus on its Master Plan.

At FinTechBrains, analysts have observed Tesla’s growing emphasis on its 5-step Master Plan 3, which aims to transition to sustainable energy across various sectors like heat generation, transportation, and industrial manufacturing.

Tesla identifies five main areas crucial for advancing sustainability:

- Using renewable energy for the grid

- Switching to heat pumps

- Adopting electric vehicles

- Utilizing heat delivery and hydrogen

5. Tesla stock price prediction 2027?

Rising oil prices have historically led to U.S. recessions, with the post-COVID era enhancing this trend. Many economies, heavily dependent on oil consumption, are vulnerable to these fluctuations, making oil prices a critical factor in economic stability.

Tesla’s shift from gasoline and diesel to diverse energy sources powering the U.S. electricity grid seems to stabilize by 2027 and could reduce vulnerability in transportation energy demand.

Such a transition appears to be not just possible, but already in progress with Tesla which leads our finance analysts to forecast Tesla’s share price target to strongly hover around $ 436 / share price by the year 2027, with a potential high of $ 505/stock price and a potential low of $198/stock price.

The projected CAGR returns for 2027 stand at 27%. If you invested in Tesla in 2017, your investment would have grown by an average of 27% annually over the next 10 years.

6. Tesla stock price prediction 2028?

By 2028, Tesla is expected to replace third-party software with its operating system for services like warehousing and human resources. This shift could push Tesla’s share price target to $474 per share by 2028, with an average predicted high of $549 and a low of $216 this year.

FinTechBrains researched Tesla’s past annual reports and discovered that Tesla has been gradually reducing its dependence on third-party suppliers by bringing more processes in-house.

Tesla is expected to advance its in-house software hub for testing subassemblies before vehicle installation by the year 2028. This move could enable Tesla to use software for diagnosing vehicle service needs, scheduling service center visits, and proactively sending necessary service parts.

7. Tesla stock price prediction 2029?

Given the macroeconomic situation and Tesla’s future strategies, profiting in the EV market appears challenging. To overcome this, Tesla may prioritize scaling up car sales volume to sustain free cash flow.

Tesla would have improved their battery technology and increased production of advanced batteries, like the 4680s. This addresses a key obstacle in transitioning to sustainable energy and making cars more affordable.

Our finance experts anticipate Tesla’s Full Self-Driving (FSD) feature becoming more accessible to all customers, as Tesla reduces the need for subscriptions through its in-house software hubs. This outlook helps our finance model to predict the Tesla stock prediction to reach $512 per share.

The predicted CAGR returns for the year 2029 rounds up to 23%, i.e. had you invested in Tesla in the year 2019, in the next 10 years your investment would reap a compounded interest of 23%.

8. Tesla stock price prediction 2030?

With climate change a pressing issue, governments are pushing for EV adoption. Tesla targets 1% of the 2 billion vehicles on roads today, all needing to shift to electric to tackle climate change.

Even with a more modest estimate of capturing 0.5% of the market, we foresee Tesla producing between 10 to 20 million cars annually by 2030. This could drive Tesla’s stock price to a fair value of $550 per share by 2030, with an average high prediction of $638 per share and an average low of $251 per share.

9. Tesla stock price prediction 2034?

According to our prediction, the Tesla stock price will be around a fair value of $701/ share price making a year-on-year jump of 6%-7% from its previous year. Our financial model calculates a predicted CAGR of 8% -15% by years 2034 – 2035 had you invested in the stock in 2024.

Our system also managed to study Tesla’s last 10 years’ stock behavior and predict a pattern of some unexpected spikes in the Tesla share prices due to COVID or a 5:1 stock split in 2020 thereby forecasting the Tesla stock price to make at least one time high of $4742 between the year 2030 to 2040 and again re-correct to its fair value.

10. Tesla stock price prediction 2038?

Using data from annual reports and world economy forums, our team forecasts Tesla’s stock price to reach approximately $852 per share by 2038. This prediction includes an all-time high of $992 per share and an all-time low of $395 per share by 2038 year.

Electric vehicles would strongly offer a two-fold promise by this year: they could reduce both environmental and economic risks.

As more vehicles would switch to electric, the economy becomes less vulnerable to oil-related risks and price shocks. Tesla’s advancements in battery and charging tech will lead to smaller, more efficient batteries, reducing energy needs for production, charging, and recycling.

Based on our past 10-year analysis of Tesla’s stock behavior, we’ve identified patterns like unexpected spikes due to events like COVID-19 or the 5:1 stock split in 2020. Our forecast suggests Tesla’s stock could reach a high of at least $4742 between 2030 and 2040 before potentially returning to its fair value.

11. What will Tesla stock be worth in 2040?

After making fair algorithmic computations from the data on the renewable Energy information and Tesla’s future plans, our advanced financial model predicts the Tesla share price to tap into $928/share price value while rendering an all-time high of $1081/share price or an all-time low of $431/share price.

As the grid becomes greener by the end of this decade, electric vehicles will increasingly use cleaner and renewable energy sources.

The U.S. Energy Information Administration forecasts a decrease in fossil fuel electricity generation from 60% in 2023 to 33% in 2030 and 28% in 2040. At the same time, the share of renewable energy is projected to increase from 22% in 2022 to 49% in 2030 and 58% in 2040.

Our analysis of Tesla’s stock behavior over the past decade identified patterns, including unexpected spikes caused by events like COVID-19 or the 5:1 stock split in 2020. Based on this, our forecast suggests Tesla’s stock could reach at least one high of $4742 between 2030 and 2040 before potentially returning to its fair value.

12. What is a fair price for Tesla stock?

According to the DCF valuation model, we considered the 3-year average free cash flow and factored in the growth rate of 18% for the first 5 years and 10% for the last 5 years, and with the help of total debt and cash and cash balances, one Tesla stock is valued at around $75. This indicates that the stock is overvalued by 54%, considering its current price of USD 157.11 in 2024.

Though the company has amazing growth in sales and revenue every year, we have often heard Elon Musk pointing out that making money in the EV sector is slightly difficult. Though Tesla has had slight fluctuations in the Profit After Tax year on year the fact they have mostly had a positive profit and a good free cash flow generated from their operating business showcases the strength of the company’s core business model.

13. Is Tesla a buy or sell right now? | Is Tesla bullish or bearish?

As of April 2024, Tesla is bearish post one of its annual meetings not discussing much-awaited news on their affordable cars. But from a long-term investment perspective, Tesla has been an innovator and a pioneer in the EV sector which resulted in this stock being a multi-bagger.

With climate change being a serious topic, governments are going to promote EVs more in the future making this sector an integral part of the world’s economy and Tesla being one of the top companies for manufacturing EVs looks bullish from the long-term perspective.

14. What is Tesla’s 5-year return?

| Year | Tesla (in %) | Index (in %) | Automobile Industry (in %) |

| 1 – month | -13 | 3 | -5 |

| 3 – months | -29 | 10 | -9 |

| 6 – months | -29 | 24 | -8 |

| 1 – Year | -15 | 30 | 8.54 |

| 3 – Years | -8 | 10 | -4 |

| 5 – Years | 57 | 14 | 21 |

| 10 – Years | 26 | 12 | 11 |

The above numbers clearly say how difficult it is to run any automobile company

15. What if I invested $1,000 in Tesla 10 years ago?

As you notice above, the average CAGR for the past 10 years of Tesla stock from 2014 to 2024 comes up to 26%. So if you just calculated as per the average CAGR %, the $ 1000 invested in Tesla in 2014 would have been $10,085.69 per share by the year 2024, which is an exceptional return compared to S&P index returns in this period.

But if you factored in the irrational spikes in the Tesla stocks during the COVID and stock split period, your $1000 invested in Tesla 10 years ago would have touched $100,000 per share value.

16. Is Tesla stock in trouble? | Conclusion

Tesla has rolled out three master plans so far. The first, from August 2006, aimed to build electric sports cars, fund an affordable car, and offer zero-emission power generation. The second, introduced in July 2016, focused on creating solar roofs with integrated battery storage and developing Full Self-Driving (FSD) features.

While Master Plan 3 is a huge step towards future shifting to sustainable energy, Master Plan 1 was a great success compared to master plan 2.

6 Comments